When it comes to investing in stocks, I’m a little “unusual” in my approach.

Whereas most people search for the “hottest” sectors to invest in, I on the other hand, am on the lookout for the most “hated and unpopular” ones.

Experience has taught me that the most profitable trades are the ones where you have to do the psychologically impossible: i.e. buy when others are scared and sell when others are excited with euphoria.

That is why I am considering buying these “hated” stocks right now…

Currently gold mining stocks are still “dirt-cheap”: they are down nearly 35% since their peak in September of last year.

One of the major reasons why gold stocks have done so badly is due to the strength of the financial banking stocks. Take a look at this chart:

The upward slope of the above chart shows that financial stocks have been outperforming gold stocks in the past six months. Since gold is seen as a hedge or “insurance” against a crisis in the financial or banking sector, it has not been doing so well.

The strong US dollar (which back in January we correctly predicted would rise in the short term) has not helped gold and mining stocks either.

However, as you’ll see from the chart below, the time is getting very close to start “loading up” on the top quality gold mining stocks:

The Gold BUGS index ($HUI) is an index of companies involved in gold mining and provides major exposure to near term movements in gold prices. It is down 35% since September 2012.

Notice that the index is getting very close to breaking above that red downward trend-line. Once that happens, I’m considering to buy more gold stocks. You’ll see that the last time it broke its down trend-line was back in August 2012 which resulted in a rally in the gold stocks.

So which stocks am I focusing on right now that are “dirt-cheap”?

Firstly, I never buy any stock just because it is cheap. I also look at the “quality” of the stock and its underlying company.

One of my favourite mining stocks is a Canada based company called Yamana Gold (AUY). I have often described Yamana as being the “Mercedes Benz” of the gold mining stocks.

Four reasons why I like Yamana is that it is the lowest cash cost per ounce of gold among its competitors (source: GSA), between 2011-2012 it out-performed all its competitors as well as the Gold ETF, it mines in politically stable regions of South America and it still remains undervalued.

In the above chart we can see that Yamana has broken its uptrend line. Therefore I would need to see it go above this line and close above $15 before I consider buying its stock.

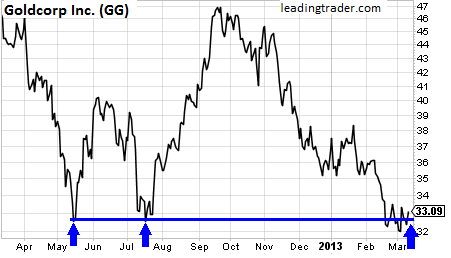

Another favourite gold contender of mine is Goldcorp (GG) – see its chart:

Goldcorp is currently “testing” the $33 support region. It has been here three times before: twice in May and July 2012 (see blue arrows above) and once also in May 2010.

If Goldcorp can hold this level and close above $34, I’ll be a buyer in GG. On the other hand if it closes below this support level (below $32), then it is best to wait this one out.

I have also asked ETX Capital to add a few more of my favourite gold (and silver) stocks to its trading platform. I’ll let you know about those stocks when the time comes to make the trade on my alert service.

Good investing.

Alessio Rastani is a stock market trader at www.leadingtrader.com .