I have always wondered whether there is a link between the stock market and the US Presidential election result. Can the markets in any way “predict” who will be the next US president before the US election result in November?

Well, if history repeats, it seems there is a “statistical” way that we can predict who will be the next US president.

Before I go any further, let me say that I am NOT political and I have absolutely NO biases or affiliations to ANY political party. It does not matter to me who wins the next election. I made my own personal views known a year ago as to who I believe REALLY rules the World and America.

The Stock Market Correlation

According to a study by the European Journal of Social Sciences (EJSS) there is an interesting correlation between the stock market and the actual election result. This was published in a paper titled The Stock Market and Presidential Election Polling.

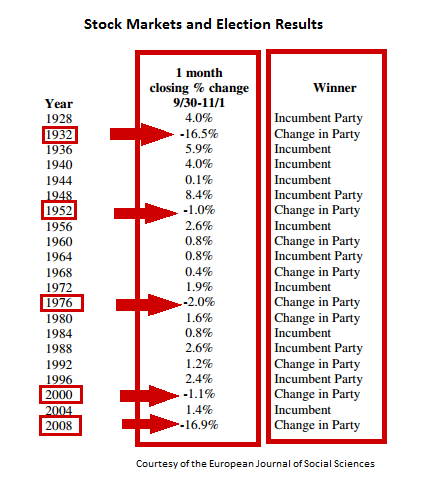

Take a look at this table which shows how the stock market acted in the final month immediately before the election and the actual election result:

Every negative change in the stock market over the final month before an election in the past 80 years has resulted in a change in party.

The analysis found that “every negative change in the stock market over the final month before an election in the past 80 years has resulted in a change in party.

A positive change tends to be good for the incumbent party, whereas a negative change makes the incumbent’s party vulnerable to losing.”

The stock market under analysis was the S&P 500, the index of the 500 largest companies in the world. The “incumbent party” in 2012 would be the Democrats under President Obama.

So let’s take a look now at how the stock market acted in the final month before the election, the period from 30th September to 1st November 2012 (i.e. October 2012).

Take a look at this monthly chart of the S&P 500 Index (SPX):

The S&P 500 index (SPX) closed on a negative in the month immediately before the election (as shown by the blue arrow).

The above chart shows that the stock market had a negative month in October (as shown by the blue arrow). The S&P 500 index closed at 1440.67 on September 30th 2012 and opened at 1412.20 on 1st November 2012 (the period measured by the Study). That is a 1.98% decline in the final month before the election.

Therefore if the analysis by the Study is correct, it would mean that since the stock market closed on a negative in the month of October 2012 – the final month before the elections – Obama’s presidency is vulnerable to losing.

So if history repeats, Mitt Romney will be the next US president.

The above data may not be altogether convincing. The EJSS admits that even though “it appears that downturns in the market have led to changes in the winning party… there is no statistically significant evidence for this” (my emphasis).

But is there other data which could support this conclusion? Maybe data from who is contributing the most to the individual candidates?

Who Are the Banks Betting On?

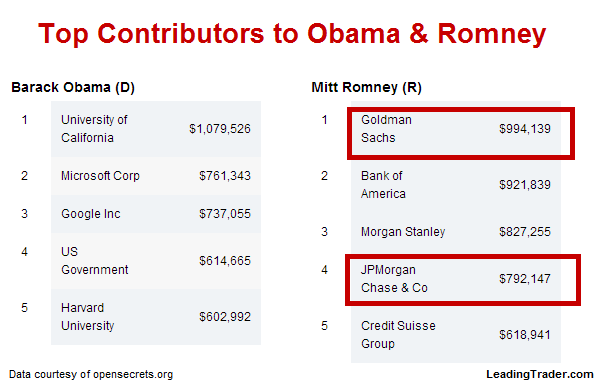

I recently came across this piece of information from a very useful website OpenSecrets.org which shows who are the top contributors to the presidential candidates, Barrack Obama and Mitt Romney.

Goldman Sachs is the top contributor to the Romney campaign. However, Goldman Sachs was the top contributor to Obama in the 2008 election.

According to Open Secrets, the top contributor to the Romney camp is Goldman Sachs with $994,139. It should be remembered that Goldman Sachs was Obama’s main contributor in the 2008 election (according to the Washington Examiner).

Conclusion

The correlation between the stock market and the US election results as found by the European Journal study is certainly interesting.

If Obama wins a second term in 2012, it will be the first time in 80 years that the correlation has failed.

Furthermore, will the fact that the majority of the big banks like Goldman Sachs and JP Morgan are supporting Romney and not Obama play a significant factor in the election result? I cannot be sure.

In my view, the race and the outcome of the Presidential elections still remains open and a very close one. I cannot say that I have any idea who will win the election.

Let me know your own views about the above findings. Do you find any patterns or reasons that I have missed here? Do you find any of the finding discussed in this article convincing? Leave me your own comment below.

Alessio Rastani is an independent and full-time stock and forex trader at LeadingTrader.com

Hi, Alessio, good article and quite informative. I’ve never analysed the markets with politics before hearing you last year. I found the Goldman Sachs swap highly interesting. Would this be where ‘Goldman Sachs rules the world,’ comes into play? I’d like to know more about how you see the banks role in this. Thank you.

That’s really interesting and exciting, but i agree there are so many factors that determine presidency.

Hey Alex – thanks for your comment. Glad you liked the article. cheers.

Greetings Alessio, I can call you by your first name because I am old enough to be your father. I did not have a son but two beautiful daughters so forgive me if I indulge you abit.

As for the election and markets, as a U.S. citizen I do not see much difference at this point. This from a Vietman era veteran. But the markets are an whole other ball of wax. I see the Sach’s of the world crushing the metals to pump up the equities, then selling on a DUMP the equities, and with the killing going back to metals. Only THEY can crush metals to pump equities and sell at TOP to to rake in metals. I have seen this before without needing charts. Their is an advantage to old age. If you live long enough, you will see everything. My best wishes to your parents, they must be very proud of you. Keep up the good work and your nice smile. It is needed in todays world.

God Speed.

Hi Carlos – thanks for the awesome blog comment, appreciate it. Yes by all means call me Alessio. First time I think I have had the pleasure of getting a comment from a Vietnam veteran, so it is great to get your input. Interesting take on the metals there. Yes it seems the financials are the only thing keeping this market on its knees, but that won’t last long. Keep up the good work also Carlos, cheers! Regards, Alessio

Hi Alessio, quite interesting reading. Thanks for sharing.Let’s wait for the results.

Thanks Renata – appreciate it.

They are all maggots. I voted for the libertarian only because Ron Paul was forced out due to the well documented early on election fraud.

In a way, I don’t care. Americans are going to get exactly what they deserve. I just want to make some money and get out of Dodge before the collapse!

Whoops! Did I say that out loud? I think I am cookie from studying too many Momentum and Day Trading video’s. LOL!

Hi Andrew. Thanks for your input on the article. Matter of fact, out of all the candidates, Ron Paul was the one that seemed to me as with something that could fundamentally change things for the better. Well done on the getting started on the momentum and day trading DVDs. Good job. Regards, Alessio

The fact that Goldman Sachs’ stock was up 8.0% from September’s close to November’s open would seem to augur well for Romney’s election chances, since presumably a Romney victory would be viewed as the better outcome for global financial firms such as GS. That is just an observation I am making, not a statement of support for Romney’s candidacy.

Neil – that is an interesting point about Goldman Sachs stocks being possibly related. I can see that. I think you’re right, a Romney win may well benefit the financials.

Thanks for the “food for thought.” In looking at the “change years”, some themes occur.

1932: FDR defeats incumbent Hoover, who presided over the start of the Depression.

1952: Eisenhower defeats non-incumbent Stevenson, but the country was ready for a change after 20 years of having a Democrat in the WH …and Ike was a national hero.

1976: Carter defeats “incumbent” Ford who became President after Nixon stepped down as President due to Watergate

2000: Bush defeats non-incumbent Gore (with an asterisk) as the Supreme Court stopped the voter count in Florida. If Florida had been permitted to complete their ballot tallies, the trends at the time were favorable to Gore.

2008: Obama defeats non-incumbent McCain with Bush leaving office very unpopular and the collapse of the world’s economy

2012: President Obama is an incumbent and the economy is in a very slow recovery. So overall, the economic trend over the last 4 years may favor Obama, regardless of what the October data show. If you look at Nate Silver’s analyses found at fivethirtyeight.blogs.nytimes.com/ , it seems to indicate a “slight” lead when a state-by-state analysis is done. That analysis can’t account for either the polarization in the country or voter turn-out…with the latter probably going to decide the outcome. Unlike Eisenhower, Romney is not a national hero nor well liked/trusted by a large portion of the country.

If direction of the economy and the incumbency issue are relevant, President Obama seems to have a slight edge going in…and the polls (for what they are worth) seems to support that idea.

Tom – very grateful for your detailed analysis of each of the years the market resulted in a change in party. Although I remember up to 1976, I had no clue about the 1952 election. I do know of Nate Silver and his book on Randomness and signals. It does appear Obama has the edge, so yes a good point.

I’d put some money down on an 80 year trend! Also, Obama’s contributors are more frightening to me… eugenics, surveillance, and police state come to mind.

Adam – a fellow betting man. Good to hear. I know a friend of mine is putting down a bit of money on Romney.

At this moment I think that this pattern is generally reliable – but will be broken this time, thanks to an event, even Goldman Sachs has no control over: Hurrican Sandy!

Check out a very similar event, when Germany’s Chancelor Gerhard Schröder got reelected for his last term: the BH-size trend predicted a change away from the left to right side of political spectrum. Then the bad weather hit and Schröder did a good job in managing the crisis – which safed him another 4yr term.

I think the same is going to be true this time for Obama. A severe short term effect, is overruling a normally reliable long term effect.

Thanx Alessio – keep rockin’!

David – yes, I think you are right about the “hurricane sandy” effect on the elections. That may well change the outcome, despite the correlation. Thanks for the comment. Appreciate it.

Very intresting analysis and very difficult to find such a thing. I find it helpful. Moreover I’m quite astonished with contributors… Obama: universities, companies and gv. and Romney: banks! My God, the more astounding is question that people do not ask: if he gets sponsorship from banks would not he be “obliged” to pay them back???

By the way, it seems that history really likes to repeat, especially in politics and economy. So I will not be surprised if the prediction above comes true.

Thanks Allesio.

Thanks Lukasz for your input on this post. You can be sure that whoever “contributes” to a presidency – such as Goldman sachs – will be handsomely “paid back” many times over once the candidate gets into power. Cheers.

From a statistical standpoint take a look at how many outcomes there are total with a positive stock market. 16 total with 4 changes of parts a 1 in 4 proposition.

Should the 1 in 4 proposition hold true also for the negative stock market (albeit there are only 5 instances) statistics would suggest that even though it has taken 80 years to accomplish, that this is the year the presented model could fail with a 1 in 4 proposition.

It’s like a coin flip, flipping a coin only 6 times in 80 years will show a different result than flipping in 16 times during the same time frame.

It’s going to be interesting, particularly for the markets, to see how this all plays out.

Marty – that is a good point. Yes I totally agree with you – this could well be the year that the trend will not hold. I have to say that even I am not convinced about the significance of the correllation – and it could well be totally random. Many thanks.

Hi Alessio,

Your analysis seems to be a good one to me. I havent dug deeper into this situation as you learned me to watch the charts. If the Big banks are putting their bet on Mitt Romney i wouldnt bet on Obama to win. I strongley believe that Mitt Romney will win. The betting houses from Irland as infowars.com reported are waving for a Obama win. I have been watched the Obama vs Romney debate and Romney was more confident in his answers and statements than Obama. My conclusion of 3 reliable sources (Alessio Rastani, infowars.com, Presidential debate with Romney and Obama) is that Mitt Romney is the winner. I even put a small amount of money on one famous betting house that Mr Romney will be the new president. As for the american people and for the rest of the world nothing is going to change as we all know “who is ruling the world”(a hint…it is not your government).

Hi Magnus – infowars is pretty good. I like Alex Jones, he’s a cool guy. Yes I rather think their call on Obama could be right. I have a friend who is riding a couple hundred pounds on Romney. He seems confident on that. I have to say I have no idea who will win, looks interesting.

Alessio – be careful when using such predictor variables – you may be witnessing Correlation not Causation.

In fact there are 21 data points in your table. Change in party is the outcome – so change in party happens 9/21 times.

You are also ignoring the other data – you point to 5 events when your hypothesis works – but ignore the other 4 where the market rises and the party changes – that’s a ratio of 5/4 – which is not something to trade on.

You can then create an odds ratio – so your event is (5/21)/(16/21) – and the alternative is (4/21)/(17/21) – then divide one odds ratio by the other – thats your answer. Also not much data to base the hypothesis on either.

I am a statistician – sorry – but people may trade on this and its flakey!!

rb

Hi Richard – I totally agree with you. The correlation indeed seems a thin one. I have to say I agree that the statistics does not explain why there was a change in party in the years the markets DID have a good month. A friend of mine made a similar correlation with the Redskins football game! In any case, I think you may well have the edge on this one than me. Thanks for your feedback, appreciate it.

Very interesting, Alessio, but not fool-proof, as you say.

During the campaign it looked as if Obama was taking the lead.

Personally I would have chosen Ron Paul, despite his age, but I am not a US national!

Best regards, Shane.

PS I’m away in London this week, hope to attend the ETX Capital seminar on the 6th.

Shane – thanks for your comment. I also favoured Ron Paul (although I did not take sides) – but I did like his outlook on matters. Well done on getting on board the trading seminars. Cheers.

Interesting. The only spanner I can see is Sandy… in which is it GS or Gaia that rules ultimately?!

Thanks Denise – I agree, Sandy is the spanner in the works. Oh well, it had a good 80 year run! lol Cheers.

Pingback: Tommorrow’s election Already Decided? | Marty's Words of Wisdom

Hi Alessio, find your views interesting and informative, I always look forward to your emails.

But surely if Goldman Sachs really does rule the world Romney will win!!! lol

Hi Andy – Thanks for your comment. Very glad to hear you found the article informative and interesting. In regards the election, my view is, whoever wins, Goldman Sachs will be a winner – which is a sad fact indeed. take care.

Alessio, thanks!!!! You are simply “GREAT”.

Ciao Ivan

Hi Ivan – many thanks indeed! Cheers, and you rock too!

I love the analysis. FDR said, “Presidents are selected, not elected”. Always bet on the smart $, let alone the guys w the most!

Thanks Dan – hmmm, interesting quote from FDR. I like it. You’re right, bet on the smart money. If Obama wins, seems like even the smart money have got it wrong this time. haha. Cheers.

I do not understand how the US Gov can be a contributor to BO.

Perhaps you are correct! GS rules the world!! Thanks for the insight.

Hi Lin – Interesting point about GS and US Government. It seems from the website OpenSecrets that the contribution is done through the employees. So that’s probably how.

Alessio, while the findings are interesting, as you mentioned there are in deed a lot of factors to consider. I’ll throw another into the mix, the stock markets were closed for 2 days due to hurricane Sandy, this meant that the number of trading days was distorted when compared to the previous dates highlighted, bearing in mind that the decline was 1.98% for the month of October.

Donald- yes that is a good point about the market being closed for 2 days. However, the markets were tanking before the hurricane actually hit so I doubt the 2 days of closure will have made a massive difference – but then again, one never knows. Thanks for you input.

Hi Alessio,

Thanks for sharing this piece of information. It’s an interesting view. However for other reasons I believe Obama will win the elections. If I’m wrong then I guess I will have to admit that Goldman Sachs really rule the world and you would have been right all along.

Regards.

Murielle

Murielle – I am inclined to agree with you. Seems like this could be the year where stats and smart money like GS may well have got it wrong. Regards, Alessio

I suggest you go read Nate Silver’s blog

In 2007, writing under the pseudonym “Poblano”, Silver began to publish analyses and predictions related to the 2008 United States presidential election. At first this work appeared on the political blog Daily Kos, but in March 2008 Silver established his own website, FiveThirtyEight.com. By summer of that year, after he revealed his identity to his readers, he began to appear as an electoral and political analyst in national print, online, and cable news media.

The accuracy of his November 2008 presidential election predictions—he correctly predicted the winner of 49 of the 50 states—won Silver further attention and commendation. The only state he missed was Indiana, which went for Barack Obama by 1%. He also correctly predicted the winner of all 35 Senate races that year.

In April 2009, he was named one of The World’s 100 Most Influential People by Time.

Hi Kanawu – thanks for your input. Not sure if you were commenting on what I said on my blog – or are you plugging Nate Silver’s blog and book? LOL I know of Nate Silver and I know he has some interesting insights. Do you have anything substantive to say on the election race/stock market other than just mentioning what Nate Silver has done?

I was checking out the prices of puts and calls for the stocks that are said to rise if Mitt wins and in each case the calls are cheaper then the puts which leads me to believe that Obama will win.

Interesting Sean – open interest and puts/calls is a method I had not thought of. Thanks for your input.

thanks for publishing this article! Very informative!

It does give an impression that Romney is fin institutions’ chosen one! Afterall why would banks finance someone who will not help their business! Having listen to a couple of TV debates, it is not clear to me what both candidates’ will do to save the US economy.

So regardless of who wins, US will continue to accumulate debts, and this just means more power to China in the long term! It would just be awful to have a communist/socialist country overtake a capitalist one.

Hi Mei. Thanks for your feedback, appreciate it. It’s a good point you make, and I agree, no matter who wins the country will get into more debt. In regards your point about China, I have a feeling that agencies like CIA are doing everything they can to stop China over-taking America – which explains why they are sending so many troops to Australia to keep an eye on China. They have done this before, they’ll do it again. Anyway, all the best to you.

The Black Swan tomorrow?

I would love nothing less than a Black Swan Cristian. Let’s wait and see.

No surprise, really. If stock market performance is a barometer for the economy, you can expect disgruntled voters to kick incumbents out in the hope of something better. It would be interesting to see if the same effect occurs at the mid-terms.

It’s well written and in my opinion the most interesting and controversial article on US election. Also the figures have proven your arguments. Thank you.

Regards.

G’day Alessio,very good article and you raise quite a few interesting points.So,there were 5 occasions since 1928 when the stockmarket fell in October,and there was a subsequent change in party.It’s interesting to note that the ejss stops at 1928 (the eve of the wall street crash and the great depression that followed) and doesn’t go back beyond that.The presidential elections in the years 1920,1912,1896,1892,1888 and 1884 also resulted in changes in party,so I would be interested to know how the market behaved in the preceeding month.If there was a fall each time on these occasions it puts the score at 11 out of 11,instead of 5 out of 5.There are other factors that would need to be considered of course,but it would add much more strength to your findings.I also note that the major banks are backing Romney including Goldman Sachs who backed Obama the last time.Both candidates are puppets of course,and the one who gets in will be the one who is favoured the most by their shadow,globalist controllers.

Thanks Kieren for your input on this article. Very interesting statistical points you raised there. Cheers.

Pingback: OzHouse Web Selections – 07/11/2012 | OzHouse Alt News

The prediction failed because the United States has decided to vote for the guy that promises them stuff and damn the deficit.

Interesting perspective Robert. Bill O’Reilly echoed your views as well.

Really liked the article Alessio. Obama has upset the trend unfortunately. I thought the trend was supposed to be our friend! Anyway, as far as actual policy goes, there wouldn’t have been any real difference if Romney got in. They’re both very pro-Wall St and pro-empire so regardless, there’ll be more wars and more economic problems for the US. How do Americans put up with this nonsense? It’s like a choice between tweedle dum and tweedle dee and at the same time, the mainstream media paints it as an ‘exciting race’ between 2 ideologically diverse rivals. Mind you as an Irishman I can’t really criticise, since our leaders have saddled the people with 10s of billions of foreign banking debts which have crushed the economy. Yet the herd only know how to vote for the big political parties that keep on screwing them over! Most of them are too afraid and stupid to even contemplate bold and fresh ideas and still can’t even fathom the notion of making money on declining markets! Going to be interesting times on the markets in the coming few months.

Thanks for the great comment on the blog post Eoin.

So how would one understand why this hypothesis failed this time around?

Pingback: My Homepage

Pingback: The Stock Market Performance Predicts that Romney Wins - SNBCHF.COM